by Josephine Patterson

Accounting giant EY’s latest survey of senior mining and metals leaders has revealed that the sector is ready to embrace the transformation needed to meet soaring demand in the green energy transition. However, it will first need to overcome a trifecta of challenges.

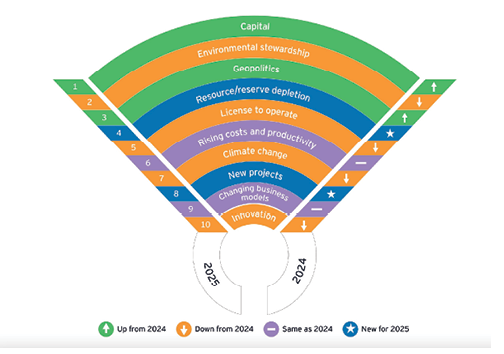

According to the survey, which was conducted in June and July, capital is the number-one risk for mining and metals companies in 2025. “Miners continue to face increased scrutiny from investors on how investment is deployed, with a strong focus on capital discipline and returns,” said EY officials. “Against this backdrop, companies are accelerating growth and amplifying value through mergers and acquisitions (M&A), spinning off noncore assets or high-growth assets.”

In its report, EY said miners should consider evolving their capital strategy to navigate long-term challenges, such as refocusing core business areas and prioritizing initiatives that align with strategic objectives and goals. Companies should also consider investing in managing sustainability risk, noted the firm, by financing new technologies aimed at preventing adverse events.

Rounding out the top three risks and opportunities for mining and metals companies next year, according to EY’s report, are environmental stewardship and geopolitics. Miners have elevated environmental stewardship above a broader focus on ESG. “The push toward nature positive – the goal to halt and reverse nature loss by 2030 – has been led by the International Council on Mining and Metals, and almost half of our survey respondents say they are confident of meeting their nature-positive obligations,” said EY.

Regarding geopolitics, EY said more governments are prioritizing self-sufficiency in strategic sectors, such as mining, to bolster national security. Therefore, miners may need to consider different approaches (for example, JVs with local companies and licensing) to help derisk investment in new projects in certain geographies. Additionally, companies should consider building supply chain resiliency and exploring opportunities in electric vehicles and energy.

EY’s “How do miners confidently shape opportunities to create new value? Top 10 business risks and opportunities for mining and metals in 2025” can be viewed on the firm’s website, www.ey.com.